Global Edible Oil Market Outlook 2024-2025: Trends, Challenges, and Opportunities

Published: October 4, 2024Category: Industry Analysis

Executive Summary

The global edible oil market is entering a transformative period characterized by shifting consumer preferences, technological innovations, and evolving supply chain dynamics. With a projected market value of $245 billion by 2025, the industry faces both significant opportunities and challenges as it navigates post-pandemic recovery, climate change impacts, and changing dietary patterns.

Market Size and Growth Projections

Current Market Landscape

- Global market value: $220 billion (2024)

- Projected value: $245 billion (2025), representing 11.4% growth

- Annual consumption: 225 million metric tons

- CAGR (2024-2025): 4.2%

The market growth is primarily driven by:

- Rising global population (expected to reach 8.1 billion by 2025)

- Increasing disposable incomes in developing economies

- Growing demand for healthy and sustainable food options

- Expansion of food processing and retail sectors

Key Market Segments

By Oil Type

Palm Oil

- Market share: 32% ($70.4 billion)

- Key challenge: Sustainability concerns and deforestation issues

- Growth driver: Rising demand in food processing and biofuel sectors

- Regional focus: Southeast Asia remains dominant producer

Soybean Oil

- Market share: 28% ($61.6 billion)

- Key producers: USA, Brazil, Argentina

- Growth trend: Increasing demand for non-GMO and organic varieties

- Application: Food processing, cooking oils, industrial uses

Rapeseed/Canola Oil

- Market share: 16% ($35.2 billion)

- Regional stronghold: Europe and Canada

- Premium positioning: Health benefits driving demand

- Innovation focus: Low-erucic acid varieties

Sunflower Oil

- Market share: 12% ($26.4 billion)

- Geopolitical impact: Ukraine-Russia conflict affecting supply

- Recovery outlook: Strong demand in European markets

- Quality focus: High-oleic varieties gaining traction

Specialty and Premium Oils

- Market share: 12% ($26.4 billion)

- High-growth segments:

- Olive oil: 8% annual growth

- Coconut oil: 12% annual growth

- Avocado oil: 15% annual growth

- Specialty seed oils: 10% annual growth

Regional Market Dynamics

Asia-Pacific

- Market size: $125 billion (57% of global market)

- Key drivers: Population growth, urbanization, rising incomes

- Major markets: China, India, Indonesia, Japan

- Trends: Shift toward premium and healthy oils

- Growth rate: 5.2% annually

Europe

- Market size: $42 billion (19% of global market)

- Key drivers: Health consciousness, sustainability focus

- Major markets: Germany, France, UK, Italy

- Trends: Organic and sustainable sourcing

- Growth rate: 2.8% annually

North America

- Market size: $28 billion (13% of global market)

- Key drivers: Health trends, convenience foods

- Major markets: USA, Canada, Mexico

- Trends: Non-GMO, clean label products

- Growth rate: 2.1% annually

Latin America

- Market size: $15 billion (7% of global market)

- Key drivers: Local production, export opportunities

- Major markets: Brazil, Argentina, Mexico

- Trends: Value addition and processing

- Growth rate: 3.8% annually

Middle East & Africa

- Market size: $10 billion (4% of global market)

- Key drivers: Population growth, import dependency

- Major markets: UAE, Saudi Arabia, South Africa

- Trends: Import substitution, local processing

- Growth rate: 4.5% annually

Emerging Trends and Innovations

Health and Wellness Focus

- Omega-3 enriched oils: Growing demand for heart-healthy options

- Low-saturated fat alternatives: Plant-based oils gaining popularity

- Functional foods: Oils fortified with vitamins and antioxidants

- Clean label movement: Demand for minimally processed oils

Sustainability and ESG Factors

- Certified sustainable palm oil: RSPO certification becoming standard

- Carbon-neutral initiatives: Companies adopting net-zero targets

- Biodiversity conservation: Protecting ecosystems and wildlife

- Circular economy: Waste reduction and recycling programs

Technology Integration

- Precision agriculture: IoT and AI optimizing crop yields

- Blockchain traceability: Ensuring supply chain transparency

- Smart processing: Automated quality control systems

- Digital marketplaces: Direct farmer-to-consumer platforms

Consumer Behavior Shifts

- Plant-based diets: Increasing demand for plant-derived oils

- Local and regional sourcing: Preference for locally produced oils

- Premium and artisanal oils: Willingness to pay premium for quality

- Convenience and ready-to-use: Packaged and portioned oil products

Challenges and Risk Factors

Supply Chain Vulnerabilities

- Climate change impacts: Extreme weather affecting crop yields

- Geopolitical tensions: Trade disruptions and export restrictions

- Logistics challenges: Rising transportation costs and delays

- Raw material scarcity: Competition for arable land and water resources

Regulatory and Compliance Issues

- Food safety standards: Stringent quality and safety requirements

- Sustainability regulations: Mandatory certification and reporting

- Labeling requirements: Complex nutritional and origin labeling

- Import/export restrictions: Changing trade policies and tariffs

Market Competition

- Price volatility: Commodity price fluctuations affecting margins

- Overcapacity: Excess processing capacity in some regions

- Private label growth: Retailers developing own brands

- New market entrants: Technology companies entering the space

Investment and Development Opportunities

Technology and Innovation

- Processing equipment: $2.5 billion market for advanced machinery

- Quality control systems: $1.8 billion opportunity in testing and certification

- Digital solutions: $900 million market for supply chain technology

- Sustainable practices: $1.2 billion in eco-friendly technologies

Market Expansion

- Emerging markets: Africa and Southeast Asia offer growth potential

- Premium segments: High-value oils commanding premium pricing

- Direct-to-consumer: Online sales and subscription models

- Value-added products: Blended and fortified oil products

Strategic Partnerships

- Farmer cooperatives: Building resilient supply networks

- Technology alliances: Collaborating with tech companies

- Cross-industry partnerships: Food processing and retail alliances

- Research institutions: Academic and industry collaboration

Future Outlook and Recommendations

Short-term Focus (2024-2025)

- Risk mitigation: Diversifying supply sources and markets

- Technology adoption: Investing in efficiency and quality improvements

- Sustainability compliance: Meeting regulatory and consumer expectations

- Market diversification: Expanding into premium and specialty segments

Long-term Strategy (2025-2030)

- Innovation leadership: Developing breakthrough products and processes

- Sustainability excellence: Achieving net-zero and biodiversity goals

- Digital transformation: Building integrated digital ecosystems

- Global expansion: Targeting high-growth emerging markets

Recommendations for Industry Players

- Invest in sustainability: Make ESG factors core to business strategy

- Embrace technology: Adopt digital tools for efficiency and transparency

- Focus on premium segments: Differentiate through quality and innovation

- Build resilient supply chains: Diversify sources and improve risk management

- Develop local markets: Invest in emerging economies with growth potential

Shengshi Hecheng Perspective

As a leading manufacturer of hydraulic oil presses, Shengshi Hecheng is well-positioned to support the industry's transformation. Our advanced equipment enables efficient processing of various oilseeds while maintaining product quality and nutritional value. We recommend that oil processing companies focus on premium positioning, operational efficiency, and sustainable practices to capitalize on the growing market opportunities.

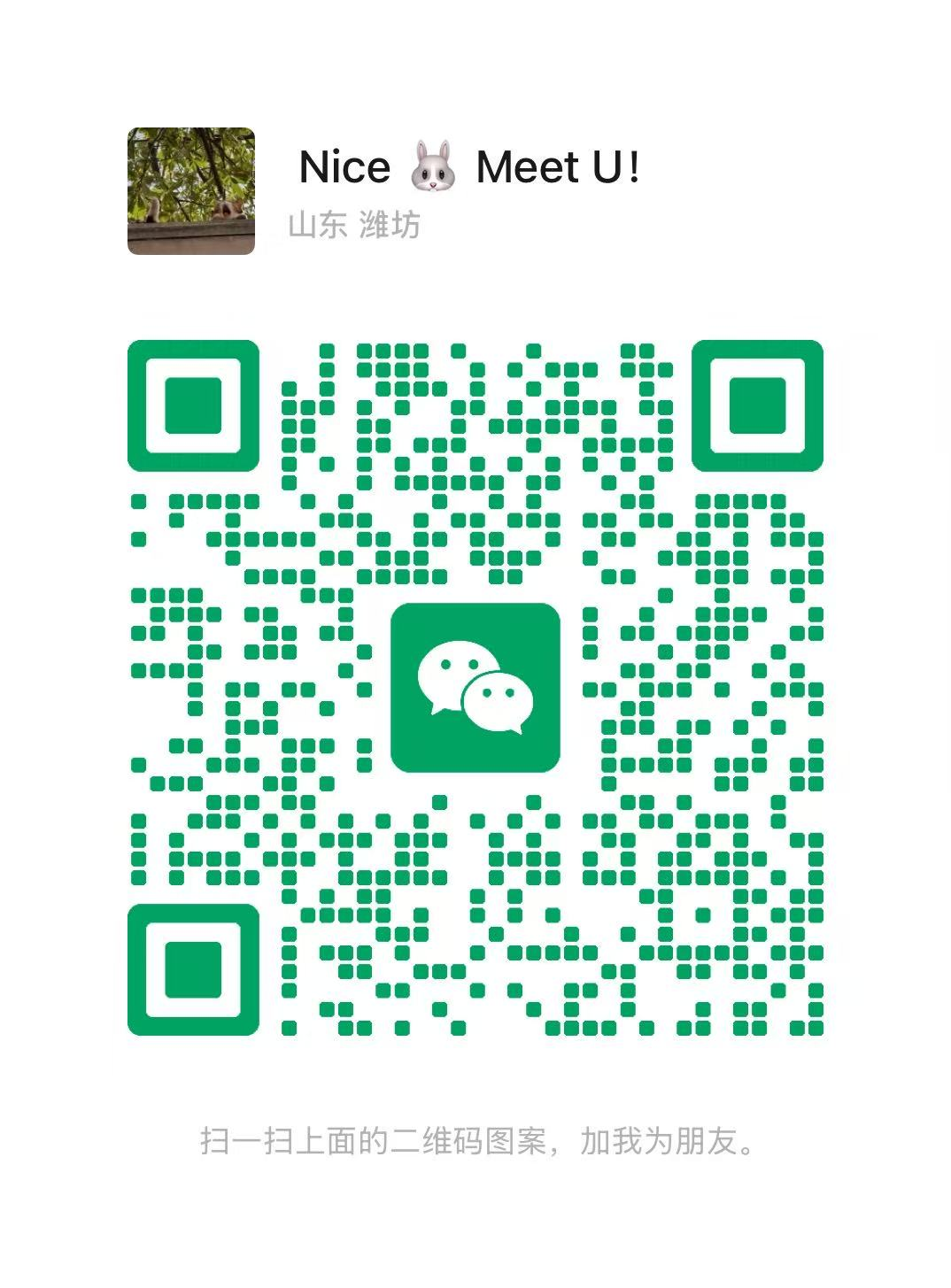

For detailed market analysis or equipment recommendations, contact our technical team at +86 199 0636 5856.